RoosterMoney* is in 2016 gelanceerd met de missie om kinderen financieel te 'opvoeden, motiveren en empoweren'. RoosterMoney is een zakgeld-app waarmee zowel kinderen als ouders zakgeld kunnen beheren vanaf dezelfde rekening.

RoosterMoney heeft een verscheidenheid aan hulpmiddelen voor kinderen van alle leeftijden, variërend van 3 - 17 jaar oud, zodat kinderen al op jonge leeftijd over geld kunnen leren. Dit artikel bespreekt de zakgeld-app RoosterMoney en legt uit hoe het werkt, hoeveel het kost en hoe het zich verhoudt tot andere zakgeld-apps zoals GoHenry en Osper.

RoosterMoney* is een zakgeld-app waarmee je je kinderen over geld kunt leren en ze financiële onafhankelijkheid kunt geven terwijl je toch controle hebt over hun financiën.

Het opzetten van een account is eenvoudig, u hoeft alleen uw volledige naam en een e-mailadres op te geven en vervolgens een wachtwoord aan te maken. U wordt gevraagd hoe uw kinderen naar u verwijzen - b.v. mama of papa - en welk land en welke valuta je op de app wilt gebruiken. U wordt dan gevraagd in welk aspect van RoosterMoney u het meest geïnteresseerd bent - b.v. de Sterrenkaart of de Rooster Card - maar u hoeft deze niet te kiezen om u aan te melden.

Nadat je je hebt aangemeld, kun je in de app spelen om te zien welke functies je wel en niet leuk vindt, en vervolgens desgewenst op een later tijdstip upgraden naar een premium account.

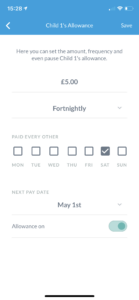

Nadat u een account heeft aangemaakt, wordt u gevraagd om kinderen toe te voegen aan de app. U moet de naam, de geboortedatum en het geslacht van uw kind doorgeven. U heeft ook de mogelijkheid om het zakgeld van uw kind in te voeren en of het dit wekelijks, tweewekelijks of maandelijks ontvangt.

In eerste instantie worden alle kinderen die u aanmaakt automatisch ingesteld met een Virtual Money Tracker-account, de gratis versie van de RoosterMoney-app. U heeft de mogelijkheid om te upgraden naar de Rooster PLUS- of Rooster Card-accounts. Voor meer informatie over de verschillende accounts die beschikbaar zijn bij RoosterMoney, klik hier.

(klik om afbeeldingen te vergroten)

RoosterMoney heeft drie verschillende rekeningen waarmee u het geld van uw kind kunt volgen. We hebben ze samengevat in de onderstaande vergelijkingstabel.

| Virtuele tracker | Haan PLUS | Haankaart | |

| Leeftijdsbereik (jaren) | 3+ | 5+ | 6-18 |

| Jaarlijkse kosten | Gratis | € 14,99 (1 maand gratis) | € 24,99 (1 maand gratis) |

| Sterrendiagram | | | |

| Geld virtueel bijhouden | | | |

| Schemavergoeding | | | |

| Geldpotten | | | |

| Kinderlogin | | | |

| Chore-tracker | | | |

| Rentebepaler | | | |

| Onbeperkte voogden | | | |

| Stel regelmatige betalingen in | | | |

| Real money deposits | | | |

| Prepaid debit card | | | |

| Flexible parental controls | | | |

| Debit account details | | | |

*Currently only available in the UK

The RoosterMoney Virtual Money Tracker account is the free version of the RoosterMoney app. It is suitable for children from 3 years old and allows you to virtually track your child's pocket money. This means that no physical money is loaded onto the app, but if you give your child a regular allowance, you can keep track of how much you give them within the app.

If the child spends, saves or gifts some of their allowance, this can also be updated in the app so both you and the child can track how much pocket money has been spent or saved. You also get access to a virtual reward chart, but to use this, you'll need to set the child's currency to stars. You can then set goals for your child to work towards and reward them in stars for good behaviour to help them to achieve their goal.

The RoosterMoney PLUS account has all of the features of a RoosterMoney Virtual Money Tracker account, as well as the additional feature of a chore tracker. It is suitable for children from the age of 5 years old and allows you to set tasks for your child to complete.

As your child completes each task, they can get rewarded by earning their pocket money allowance. You can set two types of chores:allowance chores and extra earners. An allowance chore has to be completed for the child to receive their allowance, and an extra earner chore allows the child to earn additional pocket money on top of their allowance amount. To encourage saving habits, you can also set an interest rate within the app. This is a notional interest rate that is funded by the parent and can be selected within the app under the 'Save' pot settings.

Rooster Plus also allows you to set up a recurring payment within the app for things you would like your children to contribute to, such as pet food or maybe a TV and film subscription. The regular payment amount will be deducted from the child's pocket money allowance amount on the day you have chosen for the allowance to be delivered.

The RoosterMoney Rooster Card is a prepaid contactless Visa debit card that allows your child to spend and manage their own money whilst allowing you to oversee the account via the app. A Rooster Card allows parents to set daily, weekly, and monthly spending limits, as well as ATM and single transaction limits.

The debit card can also be used abroad for free, as long as transactions are kept below £50. Any transactions over the £50 limit will be charged a 3% fee. As well as getting a Rooster Card, you can also benefit from the same features included with the Rooster PLUS and the Virtual Money Tracker account.

You can choose between three RoosterMoney accounts - the free account or the two different subscription accounts. In the below table, we summarise the subscription fees and any fees associated with a RoosterCard. You can scroll down for further detail on the account limits.

| Fees | |

| Virtual Tracker | FREE |

| Rooster Plus | £1.99 per month/£14.99 per year (first month free) |

| Rooster Card | £24.99 per year (first month free)* |

| Spending online | FREE (limits apply) |

| ATM fees | FREE (limits apply) |

| Foreign transactions | FREE (limits apply) |

| Debit card loads | FREE (limits apply) |

| CHAPS transfer | £10 |

| Bank transfer OUT | FREE (limits apply) |

| Rooster Card replacement fee | £5 (1 free replacement per household) |

*Additional cards cost £19.99 each year

N.B. Rooster Cards can only be loaded by a personal account (business and Paypal accounts are not accepted).

RoosterMoney is authorised and regulated by the Financial Conduct Authority (FCA). The money held in a RoosterMoney account with a Rooster Card is ring-fenced in an account with the high street bank NatWest. The money you deposit, however, is not covered by the Financial Services Compensation Scheme FSCS should RoosterMoney go bust. However, according to its website, RoosterMoney says 'If RoosterMoney went bust, our creditors would not be able to access any of your money due to it being safeguarded. The Financial Conduct Authority would simply distribute all of the funds back to our users.'

Ja. Rooster Cards can be used abroad for chip and pin and contactless transactions. You can spend a maximum of £50 abroad for free and after this, there is a 3% charge. It is also worth considering that some foreign ATMs will charge foreign transaction fees in addition to a fee for using the ATM itself.

RoosterMoney is rated as 'Excellent' on review site Trustpilot with a score of 4.8 out of 5 stars from over 700 reviews. 88% of customers rate the app as 'Excellent', citing the app as easy to set up and navigate. Parents also comment that the app provides great motivation for their children to complete chores and better understand money. Only 2% of customers rate the app as 'Bad', citing problems with accessing the money debited on the account and technical problems with some transactions.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

RoosterMoney is just one of a range of pocket money apps available. In the below comparison table, we compare RoosterMoney to other pocket money apps from the likes of GoHenry and Osper, as well as junior bank accounts from Starling and Revolut. For more information on the pocket money apps and some of the free alternatives, read our article "The best pocket money apps".

| RoosterMoney* | Nimbl | Osper | GoHenry* | Starling Kite | Revolut Junior | |

| Eligibility (years) | 6-18 | 6-18 | 8-18 | 6-18 | 6-16 | 7-17 |

| Cost | £24.99/year (1 month free) | £28.00/year (1 month free) | £2.50/month (first 30 days free) | £2.99/month (30-day free trial) | £2/month | Free (limits apply to a free account) |

| Loading fee | Free (limit applies) | Gratis | 50p instant loads or free by debit card | One free load each month and 50p thereafter | Free | Free |

| ATM fees* | Gratis | Gratis | Gratis | Gratis | Free | Free |

| Fees abroad | 3% transaction fee over £50 per month | £1.50 cash withdrawals, 2.95% transaction fee | £2 cash withdrawal, 3% fee | Up to £50 per month then 3% fee | Free | Up to £250 per month |

| Instant notifications | | | | | | |

| Set spending limits |  |  |  |  | | |

| Chore tracker | | | | | | |

| Child app | | | | |  | |

| FSCS protection | | | | | | |

*Limits apply

Overall, RoosterMoney* is a great app if you are looking to teach your children about money. The free version of the account allows access to the Star Chart and Virtual Money Tracker, but the chart can easily be replicated by a simple handmade rewards chart on the fridge at home.

In addition, it may be easy to forget to update the Rooster Money Virtual Tracker allowances manually when your child spends their pocket money. Accessing the chore tracker, however, is a great way to incentivise your child to earn their pocket money and having separate logins for children allows them to track their progress on their own smart devices, further encouraging independence - though it does come at an additional cost.

The Rooster Card account offers the most benefits for a child to manage their pocket money and is a great way to allow your child to have financial independence whilst still having access to their money and control over their spending habits.

RoosterMoney is marginally cheaper than other similar pocket money accounts, but there are restrictions on how much you can spend. To find out more about the different options available for your child and their pocket money, read our articles:

Als een link een * ernaast heeft, betekent dit dat het een gelieerde link is. Als u via de link Money to the Masses gaat, ontvangt u mogelijk een kleine vergoeding, waardoor Money to the Masses gratis kan worden gebruikt. Maar zoals u duidelijk kunt zien, heeft dit op geen enkele manier invloed gehad op deze onafhankelijke en evenwichtige beoordeling van het product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - RoosterMoney.